Bloomberg has an interesting article on how Sotheby's has now joined Christie's in paying fees to buyers who promise to make pre-arranged minimum bids on lots. According to the article Christie's has been making these arrangements but Sotheby's was hesitant to do so because of the additional loss of transparency. Now with all of the changes at the top of the house at Sotheby's, that thought process has now changed.

Some art market experts and observers are now calling the process a pretend auction as the sale is potentially agreed to in private and then sold in a public forum.

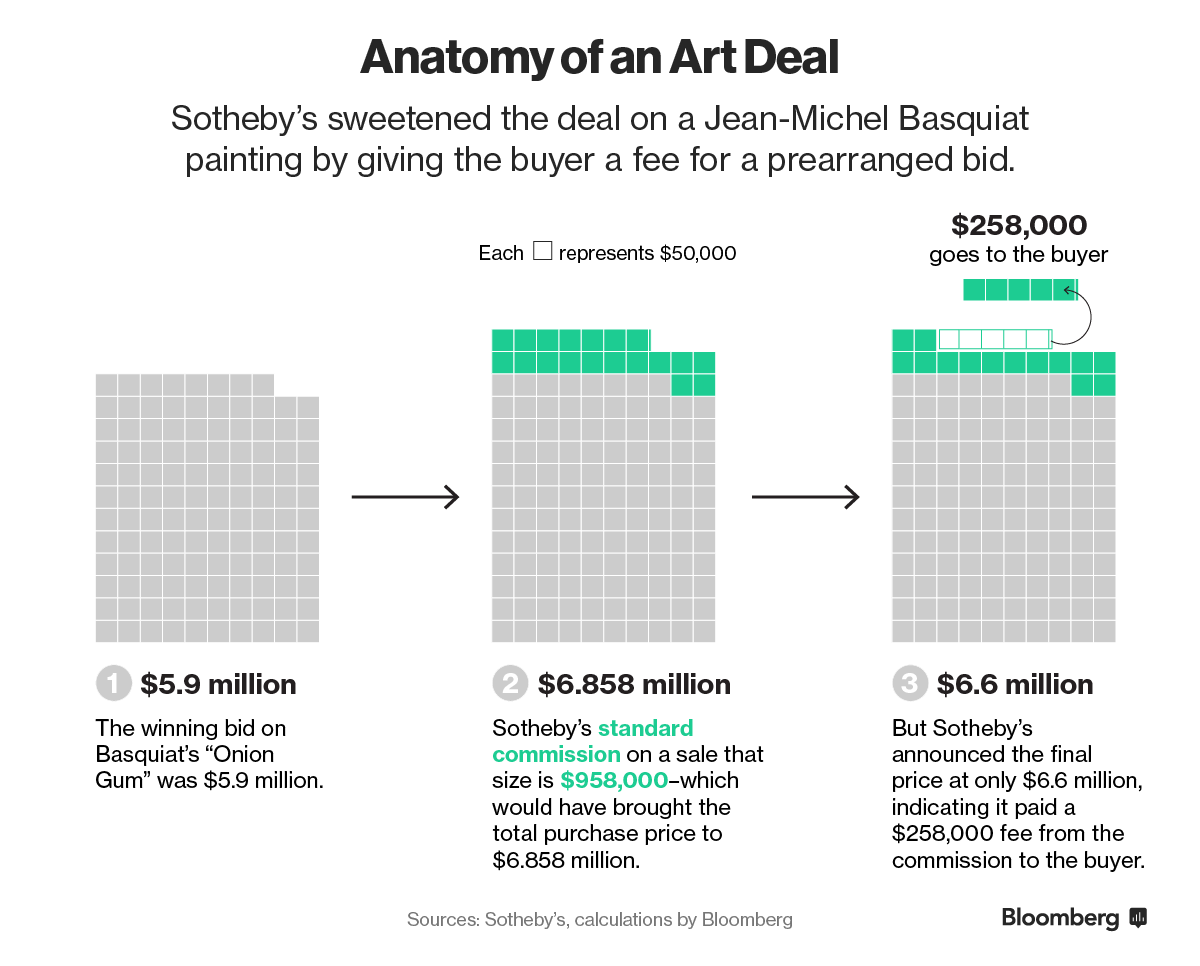

See the graphic for how the process works.

|

| Click Image to enlarge |

Source: BloombergSotheby’s was in a bind. The auction house had won several top consignments for its bellwether spring auction, including a Jean-Michel Basquiat that sold for $7.4 million four years ago, by guaranteeing the sellers minimum prices.

But as volatile financial markets sent jitters through the art world, Sotheby’s faced the prospect of owning the work if it failed to sell. In the weeks leading up to its May 11 auction, the company began pitching a new perk to potential buyers: a fixed fee to those who agree, before the auction even starts, to make at least a minimum bid. The new incentive helped Sotheby’s find buyers for guaranteed pieces.

Sotheby’s is joining Christie’s in offering the fees to buyers, whose private deals sometimes undercut the notion of a public auction market. Sotheby’s previously resisted the incentive on concerns it would reduce profit and price transparency. The auction house’s change of heart comes after new Chief Executive Officer Tad Smith reshuffled the ranks of managers and specialists and brought in a former top Christie’s executive. The company’s shares have lost about a third of their value in the past year.

Sotheby’s change “makes them more competitive on the financial side with Christie’s,” said Thomas C. Danziger, a partner in Danziger, Danziger & Muro LLP. “In the current climate, every advantage that you can have helps the bottom line. Stupid money is not flowing in the ways it might have 12 to 18 months ago.” Sotheby’s declined to comment for this story.

The new perk in Sotheby’s arsenal of incentives, disclosed in catalogs in April, sweetens the deal for investors who agree to step in as buyers of last resort. In the past, so-called irrevocable bidders were compensated with a part of the auction house’s sales commission only if another buyer purchased the artwork that they had backed. Now, by opting for a fixed fee, they are guaranteed a payout and can get the artwork effectively at discount.

‘Onion Gum’

The new approach reduces the risk that Sotheby’s ends up with too much artwork in its inventory -- a concern particularly in a slowing market. But as the May 11 auction showed, the company can still lose money.

“Onion Gum” was one of four works in that sale consigned by hedge fund manager Daniel Sundheim. Sotheby’s gave him undisclosed guaranteed prices for the paintings, and in the weeks before the auction, it lined up irrevocable bidders for the four pieces.

The Basquiat sold for $6.6 million, net of the fee paid to the mystery buyer, who was the only bidder. That was less than the guarantee to Sundheim, according to a person familiar with the matter, leaving Sotheby’s with a loss on the painting.

Transparency Concerns

Sotheby’s lists the price net of fees paid to such buyers, making it possible to estimate the fee that the company doesn’t disclose. The buyer of the Basquiat work received $258,000, based on Sotheby’s standard sales commission.

The company argues this form of disclosure is more transparent, because the fee paid to the irrevocable bidder works like a discount. Christie’s does not adjust for such fees in its reporting of final prices.

Christie’s declined to comment. The fees are “a separate transaction to the sale, reflecting the risk the third party has taken in relation to the minimum price guarantee,” the company says on its website.

Sotheby’s is offering the new incentive to investors after it took a loss on a $509 million guarantee on the collection of its former chairman A. Alfred Taubman and had to take possession of $33 million of unsold artworks last year.

Like ‘Steroids’

Auction guarantees have proliferated since the financial crisis, covering half of the $2.1 billion of art in November’s semi-annual auctions in New York. Since then, the number of guarantees at Sotheby’s and Christie’s has fallen as the market slowed. Art adviser Todd Levin says guarantees act like "steroids" in the market by presetting bids often at artificially high levels.

David Nash, a co-owner of Mitchell-Innes & Nash gallery in New York, says irrevocable bids are part of financial machinations that distort the art market. When highly valued works with prearranged bids come up for auction, in many cases there is no genuine bidding and they are bought by the guarantors, he said.

That’s what happened with Roy Lichtenstein’s "Nurse," which was purchased in November at Christie’s for $95.4 million -- an auction record for the artist that was 70 percent higher than the previous high two years earlier.

“It’s a sale agreed in private to take place in public and pretend it’s an auction,” said Nash.

Before it's here, it's on the Bloomberg Terminal.

|

No comments:

Post a Comment