Artprice just released its annual Contemporary Art Market Report - 2016 on its website. I am still reading through it, and have posted the synopsis below in the block quote. Artprice notes the Contemporary sector contracted by nearly 25% from the previous year (tracks between July 2015 and June 2016). The report notes of a short contraction in the sector during the early part of the review followed by stronger sales.

The report notes "After 12 months of shrinkage, the Contemporary art market adapted perfectly to the new environment with the major auctioneers quickly introducing their “plan B”. This involves dropping their habitual race towards new records and focusing their offer on the lower end of the high-end spectrum and the “middle market”. This change is most obvious in the restructuring of their sales: results above $50,000 have represented 6% of the lots sold compared with 8% during the previous 12-month period."

Artprice reports on the Contemporary art market (follow the source link for the full report)

Source: ArtpriceThe severe economic and financial crisis that has engulfed the entire planet since 2007, with almost ubiquitous negative interest rates as its most recent expression, has made the art market look like an oasis in the desert. Yes… it has shown signs of correction over the past year, but this was both necessary and foreseeable in a market whose most visible segment, Contemporary art, is also its most volatile.

Between July 2015 and June 2016 the Contemporary art segment generated a global auction turnover of $1.5 billion compared with $2.1 billion in the previous 12-month period. That’s a contraction of more than a quarter; but the long-term trend is still massively positive, with an increase of +1,370% since 2000.

Moreover, the correction would appear to have finished. In fact, now that the art market is an “efficient” market (thanks notably to Artprice), the major auction operators immediately reacted to the contraction by adjusting their offer as of H2 2015… and the first signs of a recovery are already visible.

Contemporary art on the front line

After four years of uninterrupted growth, turnover on the Contemporary art segment posted a sharp contraction in the first half of 2015. The movement continued in the second half of the year with the year’s turnover total down -39% versus the previous year. Nevertheless, as this report shows, the various corrections on prices, transaction volumes and individual artists’ price levels confirm the art market has reached a much higher level of economic maturity compared with the 1990s when economic turbulence had a deeper and more chaotic impact. By comparison, today’s dynamic and “smart” Contemporary art market looks like a different world altogether.

Revenue from worldwide Contemporary Art Auctions

After the extraordinary results between July 2013 and June 2014 – the most prosperous period in the Contemporary art market’s history in terms of annual turnover, volumes exchanged and auction records – some sort of market restructuring was almost inevitable. The market’s effervescence saw a lot of profit-taking coupled with an intensification of demand for relatively young signatures.

In September 2015, the New York Times journalist Scott Reyburn summarised the situation as follows: « In 2014, recently made works by young abstract painters like Oscar Murillo, Lucien Smith, Alex Israel, Mark Flood and Christian Rosa were being “flipped” at auction for eye-watering multiples of the artists’ original gallery prices.. But in the past six months or so, this volatile sector of the market […] has undergone a correction. »

Contemporary Art collectors have indeed been more cautious in recent months. While sales of Modern art continued in full swing, generating the segment’s second best auction result of all time in November 2015 ($170.4 million for Amedeo Modigliani’s Reclining Nude [1917-1918]), sales of Contemporary art entered a second consecutive semester of contraction.

Sales of very recent works (created up to three years before the sale) have been the first to feel the impact of collectors’ prudence. Their average price has dropped back to $20,000, after rising to $28,000 the previous year.

Recent Works Auction Revenue (created in the past 3 years)

Towards a recovery

Although Contemporary art is still sensitive to the worst economic troughs, it rapidly regains its vitality. In the first semester of 2016, the segment posted a milder contraction (-14%) than the rest of the art market.

After 12 months of shrinkage, the Contemporary art market adapted perfectly to the new environment with the major auctioneers quickly introducing their “plan B”. This involves dropping their habitual race towards new records and focusing their offer on the lower end of the high-end spectrum and the “middle market”. This change is most obvious in the restructuring of their sales: results above $50,000 have represented 6% of the lots sold compared with 8% during the previous 12-month period.

The strategy adopted by the major auction operators has been effective. The modification of their offer has allowed a stabilisation of prices, as indicated by the improvement in the market’s price index.

After one year of contraction, Contemporary art prices have posted a net increase in the first half of 2016, and particularly in the second quarter. The +15% recovery has been stronger than in the market’s other segments.

Price Index for Contemporary Art vs Post-War Art

Offer adaptation

As a first move, the high-end of the Contemporary art market limited its supply by imposing a very selective consignment policy. As a result, only one work was sold above the $20 million threshold in our 12 month period compared with five in the previous 12-month period. The objective of this strategy is to avoid testing demand because it could undermine the established price levels of major signatures.

For example, Christie’s, Sotheby’s and Phillips all showed high levels of restraint with works by Jeff Koons and Christopher Wool. Although both artists generated good results above $10 million, they are a long way behind their personal auction records of $58 million and $30 million respectively.

However, this restricted-offer strategy did not prevent a top quality work by Jean-Michel Basquiat from being offered at Christie’s New York on 10 May 2016 and from meeting high expectations as well. The work – Untitled (1982) – was acquired for $57.3 million by the Japanese millionaire Yusaku Maezawa, setting a new auction record for the famous New York artist. The result was immediately cited by art investment funds as a symbol of the art market’s potential… and they are not wrong! The collector who consigned the work for sale acquired it in June 2004 for just $4.5 million, which means the work accreted in value by 1,200% in 12 years, giving a per annum yield of 24%.

Top 10 results in Contemporary art

Artist Work Price Date Sale

1 Jean-Michel BASQUIAT (1960-1988) Untitled (1982) $57,285,000 10 May 2016 Christie’s New York

2 Maurizio CATTELAN (1960) Him (2001) $17,189,000 8 May 2016 Christie’s New York

3 Christopher WOOL (1955) Untitled (1990) $16,965,000 10 Nov 2015 Christie’s New York

4 Peter DOIG (1959) « The Architect’s Home in the Ravine » (1991) $16,346,086 11 Feb 2016 Christie’s London

5 Jeff KOONS (1955) One Ball Total Equilibrium Tank

(Spalding Dr. J Silver Series) (1985) $15,285,000 8 May 2016 Christie’s New York

6 Peter DOIG (1959) « Cabin Essence » (1993-1994) $14,861,789 16 Oct 2015 Christie’s London

7 Jeff KOONS (1955) Balloon Swan (Yellow)(2004-2011) $14,725,000 10 Nov 2015 Christie’s New York

8 Christopher WOOL (1955) « Untitled » (1990) $13,914,000 11 May 2016 Sotheby’s New York

9 Christopher WOOL (1955) « And If You » (1992) $13,605,000 10 May 2016 Christie’s New York

10 Richard PRINCE (1949) « Runaway Nurse » (2005-2006) $9,685,000 10 May 2016 Christie’s New York

Given the efficiency of the modern Contemporary art market, the 8% fall in the number of Contemporary works offered for sale (extending the -1% trend observed in the previous year) was a foreseeable reaction. In fact, the offer shrinkage essentially corresponds to a necessary adjustment after five years of growth (between 2009 and 2014) during which the Contemporary Art segment had almost doubled in volume (from 30,700 lots sold to 60,000 lots sold).

So… in spite of a slight contraction, the Contemporary art market still offered the third highest volume of works in its history.

Number of Contemporary Works sold at Auction

In the long term, demand remains strong, international and discriminating, driven by highly-connected collectors who are permanently informed of market realities and acutely aware of the latest trends. Despite certain hesitations, Contemporary art buyers have pursued their buying and selling and seem to have perfectly adapted to the current economic context.

Indeed, auction unsold rates have remained relatively “normal”. Christie’s and Phillips posted average rates below 30%, while Sotheby’s posted a slight increase to 34%. But this rate is still well below the unsold rates seen during past art market crises.

Since the beginning of the 20th century, the unsold “danger level” has been around 37%. In the middle of a real art market crisis, the figure has exceeded 50%. At the other end of the spectrum, an unsold rate below 20% usually indicates that the market has moved into speculative mode. The current scenario therefore suggests that the art market is in a period of long-term stability.

Market Maturity

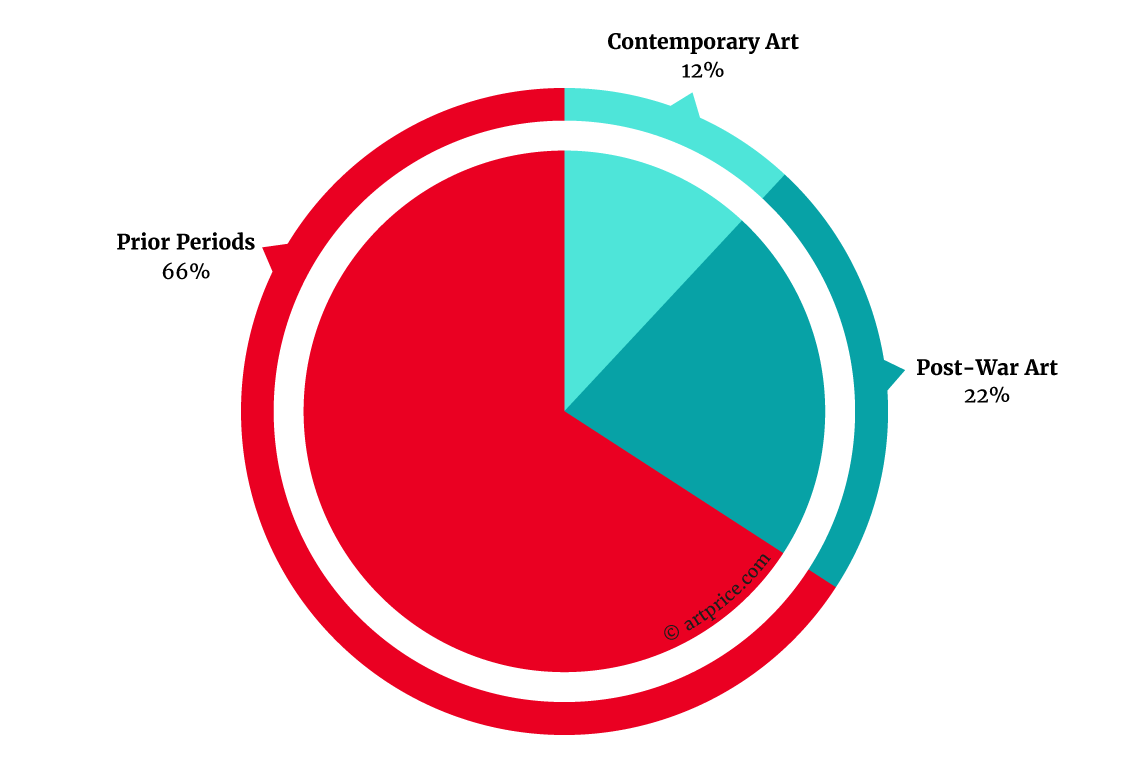

Contemporary art accounts for 12% of global Fine Art auction turnover, a substantial share and one that is largely attributable to just a handful of star signatures. Several Contemporary artists (i.e. artists born after 1945) are today fetching almost the same prices as some of the most illustrious and sought-after artists in the world (all periods combined) and the top 10 Contemporary artists all have places in the Top 100 artists by annual auction turnover all periods combined), next to Andy Warhol, Roy Lichtenstein, Cy Twombly, Gerhard Richter, Lucian Freud and Zao Wou-Ki, etc. According to art market sociologists, a historical change has occurred over the last two decades: back in the 20th century it was impossible, indeed unthinkable, that anyone should be able to apprehend the reality of the art market at any given moment. That has now changed forever.

Contemporary Art Performance in the Global Art Market

For over ten years now the Contemporary art segment has been the art market’s second most profitable segment with its prices rising nearly as fast as the Post-War segment (artists born between 1920 and 1944). Prices in the Post-War segment have literally rocketed in the context of London and New York’s dominance of the global secondary art market.

However, the Contemporary art market has demonstrated an unprecedented level of economic maturity. Based on past experience of previous crises, the major auctioneers have shown their capacity to restrict supply in order to protect existing price levels. This strategy has allowed a stabilisation of prices within a matter of months, while transactions volumes have remained high and unsold rates have remained stable.

The success of this strategy not only avoids a more protracted downturn; it also significantly contributes to making Contemporary art a high-performance long-term asset. Over the last 16 years the segment has posted an average annual yield of 4.9% while its auction turnover has grown 1,370% and its global transaction volumes have quadrupled.

No comments:

Post a Comment