Some interesting results from the Feb 28th Impressionist and Modern art evening sale at Christie's. The sale offered 50 lots with 46 lots selling for a 92% sell through rate. The sale also had a very strong 96% sales by value, with a total sales figure of $117 million.

Christie's seems very pleased with the results, yet four of the lots were identified by Bloomberg as being from the collection of a Russian billionaire who had paid far more for the works than the sold for. Is this a sign the market is weakening as there were some major losses from when purchased by the Russian collector, or were they offered too soon?

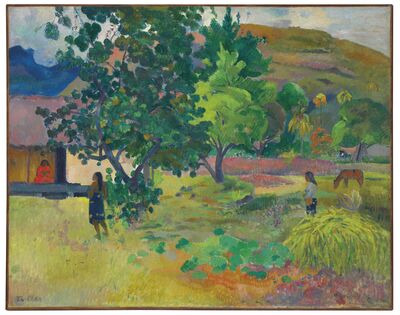

For example, from the Russian billionaires collection, the Gauguin Te Fare (La maison) had a $15-$20 million estimate, sold for a strong $25.2 million including buyer's premium, but was purchased in 2008 for $85 million (see image), and a 74% loss according to Bloomberg. A Picasso with an estimate of $8.2/10.7 million, sold for a weak $5.8 million, and was purchased in 2010 for $35 million. Read the Bloomberg article and the artnet news article for more details.

Bloomberg reports

Source: BloombergRussian billionaire Dmitry Rybolovlev paid 54 million euros (then $85 million) for a landscape by Paul Gauguin in a private transaction in June 2008. On Tuesday, he took a 74 percent loss on his investment.

Gauguin’s 1892 landscape “Te Fare (La Maison)" fetched 20.3 million pounds ($25 million), including commission, at Tuesday evening’s sale of Impressionist and modern art at Christie’s in London. Rybolovlev will net about $22 million based on the hammer price. The auction house had estimated the value at $15 million to $22.4 million. The buyer was a client of Rebecca Wei, president of Christie’s Asia.

The Gauguin was one of four Rybolovlev pieces offered for sale on Tuesday. Another work, a Mark Rothko painting, will be auctioned March 7.

Rybolovlev -- with a fortune of about $9.8 billion according to the Bloomberg Billionaires Index -- invested about $2 billion in 38 works, from Leonardo da Vinci to Pablo Picasso. They were procured privately by Swiss art dealer Yves Bouvier, known for creating a network of tax-free art storage warehouses in Singapore and Luxembourg.

Two years ago, Rybolovlev sued Bouvier, alleging he was overcharged by as much as $1 billion, Bloomberg reported. Since then the Russian fertilizer magnate has been unloading works he acquired, some at record prices. He has already sold three for a loss totaling an estimated $100 million. The five works at Christie’s, all estimated below their purchase prices, were expected to deepen the loss.

Closely Watched

“As Singapore’s highest court noted, the buyers in this case ‘obtained the masterpieces which were precisely what they wanted, and these were all transacted at prices they agreed to pay,”’ Ron Soffer, Bouvier’s lawyer, said in an interview last week, citing a ruling in a related civil case.

The art industry is closely watching the London auctions running this week and next as the year’s first test of the global market following a significant contraction in 2016. Christie’s sales fell 17 percent to $4 billion pounds ($5.4 billion) last year, while Sotheby’s reported a 27 percent decline to $4.9 billion. Both houses saw steep declines in their two biggest categories: Impressionist and modern art, and postwar and contemporary art.

A life-size bronze of a kissing couple by Auguste Rodin, “Le baiser, grand modele,” cast in 2010, found no takers. Christie’s had estimated it at $4.9 million to $7.5 million. Rybolovlev purchased the work for 7.5 million euros (then $10.4 million) in 2011.

Picasso’s 1970 “Joueur de flute et femme nue" sold for $5.8 million with commission, falling short of the low estimate of $8.1 million. Rybolovlev purchased it for 25 million euros (then $35 million) in 2010.

Rene Magritte’s 1938 “Le domaine d’Arnheim” fetched $12.7 million, with fees, surpassing the high estimate of $10.6 million. Rybolovlev paid $43.5 million for it.

Christie’s is targeting as much as 287.2 million pounds in its series of 20th century art that runs through March 10.

artnet news reports on the Christie's sale

Source: artnet newsComing in a few weeks later than usual because of Chinese New Year and half-term holidays, Christie’s kicked off the first major auction of the season last night with the British Pound at an attractive $1.242, €1.17, and Yuan 8.5. Just as the exchange rates acted as a stimulus to overseas buyers during London’s post-Brexit sales, they were set to do so again.

The evening began with 50 lots of Impressionist and Modern art with a £68.6 million/£100 million estimate that realized £94.3 million ($117 million), with only 8 percent unsold.

Four of the top lots had been identified by Bloomberg as coming from the collection of Russian billionaire Dmitry Rybolovlev, who had, according to court papers, paid far higher prices than the estimates would suggest.

Top estimate of the sale was Paul Gauguin’s bucolic Tahitian painting, Te Fare (La maison), at £12/18 million ($15/23 million). It had last sold at auction in 1991 for the equivalent of £5.2 million in Paris before changing hands. The seller now, described by Christie’s as an “Important Private Collection,” but identified as Rybolovlev, bought it at the height of the market in 2008 for $85 million, so the Chinese telephone buyer who got it for £20.3 million (or $25.2 million) may have thought it was a bargain.

This was followed by Pablo Picasso’s late painting, Joueur du flute et femme nue, bought by the seller, reportedly Rybolovlev again, for $35 million in 2010. Now estimated at £6.5/ 8.5 million ($8.2/10.7 million) it was described as the “Property of an Important Collector” (note the change of owner description). Interestingly, it was shown by Gagosian in 2016 but presumably not sold. Here it underperformed, selling to a commission bid for £4.6 million ($5.8 million).

Another work identified as a Rybolovlev sale, this time “The Property of a Private European Collection,” was Auguste Rodin’s posthumous cast of Le Baiser. However, the very recent casting (2010) may have gone against it, and it was unsold with a £4/6 million estimate. Christie’s Jay Vince would not comment on the Bloomberg story, except to say that it had not effected interest in the lots in question. “The market judges things on their merits,” he said.

Asian telephone bidding was a feature of the evening. Christie’s estimated roughly that one third of lots went each to Asia, America, and Europe, but Asia dominated the higher priced lots. It was an all Asian affair (and that includes Japan and Taiwan) for Henri Matisse’s Jeune fille anemones sur fond violet, which sold above estimate for £8.5 million ($10.5 million).

Another Asian bidder using the same paddle number as for the Gauguin, bought Paul Cézanne’s rather homely painting of his mother above estimate for £4.5 million against bidding from London dealer, James Butterwick. And yet another, this time from Japan, claimed Berthe Morisot’s elegantly attired Femme et enfant au balcon—from the German Lambrecht collection—above estimate for £4.1 million. One of the most persistent underbidders of the evening was Tan Bo, a Christie’s director in Beijing.

However, anticipated bidding from Asia did not materialize for three paintings by Le Corbusier from the Heidi Weber Museum collection. Christie’s had sent them on an Asia only pre-sale tour, and Weber is said to be planning to build a Le Corbusier Center in Shanghai. Still, the works sold above the pre-sale high estimates for a combined £9.3 million, the top price of £3.3 million ($4.1 million) just a shade below the $4.6 million record set at Phillips last year. But even though that record was only achieved on a single bid by a guarantor, the price may have acted as a stimulant to the Christie’s sales.

The only guarantees in these sales were in the Surrealist section, which maintained the tempo by reaching £43.4 million ($52.9 million) against a £32.8/$44.9 million estimate with only 9 percent of lots unsold. The section was dominated by René Magritte, whose airy La corde sensible carried a guarantee and a record-breaking £14/$18 million estimate. The estimate was so punchy it knocked out any competition, and it sold to the guarantor for £14.4 million ($17.9 million). The last time it was at auction was in 1986 when it sold for $363,000.

Another Magritte coming back to auction after several decades was Le domaine d’Arnheim, an eagle shaped snow-capped mountain. In 1988 it fetched the second-highest price for a Magritte when it sold to Isy Brachot for $825,000. In 2011 it was reportedly bought by Rybolovlev for $43.5 million, far above the auction record, and now sold above the £6.5/8.5 million estimate for a more modest £10.2 million pounds ($12.7 million). A good night for Magritte ended with a summery gouache, La triomphe du mois de Mai, which sold to London dealer, Anthony Brown, mobile phone pressed to his ear, on the high estimate for £425,000

No comments:

Post a Comment