Artprice recently released its first half 2018 global art report. According to Artprice results the art market is strong, with an initial statement of "All economic indicators are positive". The reports states art sales in the first half of the year at $8.45 billion, up 18% from 2017 first half sales. Modern art at the high end of the market represented 46% of the sales. The Artprice Contemporary index rose by 27%.

Follow the below source link for the full report

Source: ArtpriceAll economic indicators are positive

- Global auction turnover on Fine Art* rose 18%, totalling $8.45 billion

- Transactions remained stable with 262,000 lots sold, up 2.5% vs. H1 2017

- The USA posted a massive 48% increase, with total turnover of $3.3 billion

- China**, with $2 billion in turnover, reduced its unsold rate before a decisive H2

- The UK is just behind China with auction turnover up 18% to $1.9 billion,

- The EU is contributing to growth: France +8%, Germany +17%, Italy +22%

- Modern Art, the high-end market’s mainstay, accounted for 46% of total turnover

- Modigliani and Picasso both generated results above the $100 million threshold

- Zao Wou-Ki was China’s best-performer in H1 2018 with turnover of $155 million

- Contemporary Art’s global price index rose 27%, rivalling the S&P 500

*Fine Art Public Auction: painting, sculpture, drawing, photography, prints, installation

**In collaboration with the Art Market Monitor of Artron (AMMA)

A new worldwide stability

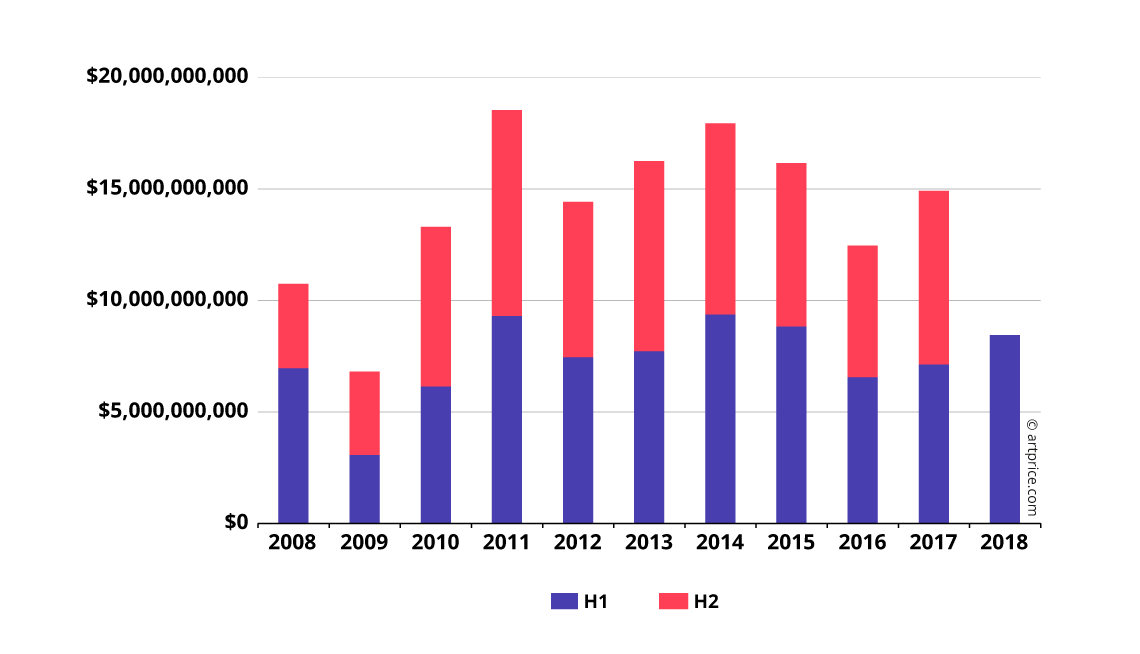

Global Fine Art auction turnover amounted to $ 8.45 billion in H1 2018, an increase of 18% versus the year earlier period. The Art Market is therefore pursuing the renewed growth which started in H1 2017 (+9%) and was confirmed in H2 2017 (+32%).

Semi-annual evolution of Fine Art auctions

Compared with the financial crisis in 2008 – and its repercussions on art prices the following year – the Art Market appears to have considerably matured and is now enjoying a new form of stability and independence. This stability is based on a very large volume of transactions: over 250,000 lots auctioned each semester, effectively constituting a solid basis for the International Art Market.

The annual differences we observe in total global auction turnover from Fine Art are essentially generated by a limited number of top-bracket lots which constitute only a fraction of the number of transactions: results above the $5 million threshold represent less than 0.1% of the transactions, but generate 40% of the turnover. This high-end market depends more than any other on the level of confidence within the market, as well as the general economic context. In fact, judging by the 229 works which sold above the $5 million threshold in H1 2018, the market perceives the current economic situation as particularly favorable: in H1 2017 the number was only 163.

The ultra-high-end market, i.e. a handful of extremely rare works (> $100 million) that are usually offered for sale in extraordinary circumstances, now also has an impact on global annual turnover totals. The $450 million paid by the Emirate of Abu-Dhabi for Leonardo da Vinci’s Salvator Mundi masterpiece last November, alone accounted for 3% of 2017’s total global auction turnover from Fine Art.

The USA again leader thanks to Modern Art

In the first half of 2018, the major Anglo-Saxon auction houses managed to maintain the enthusiasm generated by the historical sale of Salvator Mundi. The dispersion of the Rockefeller Collection gave Christie’s an excellent opportunity to start the prestigious New York spring sessions in spectacular style. The sale of 8 May 2018 alone totalled $646 million, including $115 million (incl. buyer’s fees) for one of the last canvases from Pablo Picasso’s ‘Blue Period’ still in circulation, Fillette à la corbeille fleurie (1905).

The Rockefeller Collection – the most valuable private collection ever sold – featured a prodigious number of other early 20th-century masterpieces including Claude Monet’s Nymphéas en fleur (c.1914-1917) and Henri Matisse’s Odalisque couchée aux magnolias (1923) which fetched $85 million and $81 million respectively. A few days later, on 14 May, Modern Art continued proving its power of attraction with the sale of Amedeo Modigliani’s Nu couché (sur le côté gauche) (1917) for $157 million at Sotheby’s in New York.

With 47,000 lots sold over the year’s first six months (up 9% vs. the year earlier period), the USA remains the world’s leading art marketplace ahead of France (41,500), China (36,000) and the United Kingdom (29,000). Nearly one fifth of the works auctioned worldwide are sold in the United States, and while 48% of Fine Art auction lots sold in the USA fetch less than $1,000, New York is home to the largest high-end art market in the world: the top six first-half results were hammered in Manhattan (all during May).

No comments:

Post a Comment